tax avoidance vs tax evasion australia

Tax avoidance is not tax evasion. It is also more subjective and its definition varies widely.

Drones And Quadcopters Dji Phantom 4 Drone Camera Phantom 4 Drone

61 02 8311 9993.

. However while tax avoidance doesnt break the law it still neglects the true meaning and purpose of law making. In tax avoidance you structure your affairs to pay the least possible amount of tax due. Tax evasion is lying on your personal tax structure or some other structure says Beverly Hills California-based tax.

Tax avoidance vs tax evasion. TA 20214 Structured arrangements that facilitate the avoidance of luxury car tax. Whereas tax evasion is unlawful.

While tax evasion is illegal tax avoidance involves entering into legal arrangements that exploit loopholes or unintended defects in tax law. Setting aside the tax evasion both tax planning and tax avoidance are legal. Tax avoidance is lawful and tax evasion is unlawful.

However for some time the Australian Government has ignored the difference between the two concepts when it comes to Australians using tax havens and being investigated as part of Project Wickenby1The Australian Government is deliberately labelling. Federal offences and tax evasion penalties. While you get reduced taxes with tax avoidance tax.

Claiming an exemption for a nonexistent dependent to reduce tax liability is a fraud while applying the long-term capital gain rate to a short-term earning may be seen as negligence. A further sub-set of tax aggressiveness is tax avoidance which refers to tax planning activities that have a low level of probability less than 50 of. Our dedicated team at The Quinn Group can offer expert advice on Tax Avoidance vs.

Lets start with tax evasion. An integrated accounting legal and financial planning practice with over 20 years experience. To summarise tax avoidance is a legal and legitimate strategy while tax evasion is illegal and results in harsh punishments.

Despite the similar-sounding names all three refer to completely different things let a Melbourne tax accountant tell you the difference between them. Several legal defences exist in relation to tax evasion see below. 37 ATR 321 at 323 Gleeson CJ said Tax evasion involves using unlawful means to escape payment of tax.

In the case of a body corporate the maximum penalty is a fine of 1000 penalty units about 165000. Australia is leading the global fight against multinational tax avoidance and is cracking-down on taxpayer tax evasion with a number of reforms announced as part of the 2016-17 Budget. The distinction between tax evasion and tax avoidance to a great extent comes down to two components.

The difference between tax evasion and tax avoidance largely boils down to two elements. On the other hand tax planning is highly advisable. However the ATO closely examines schemes and arrangements that might comply with the technical requirements of tax.

Tax Evasion vs. The basic difference is that avoidance is legal and evasion is not. The Australian government can prosecute tax evaders for committing offences under the Taxation Administration Act 1953 Cth.

The distinction between tax avoidance and tax evasion has been well established in the Australian taxation system. What is the main difference between tax evasion and tax avoidance. The extra funding will continue to expand our risk assurance and compliance strategies.

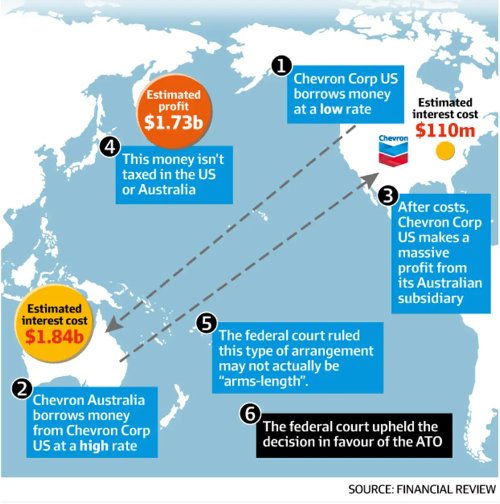

Common tax avoidance arrangements. The Australian Government funded the taskforce with 679 million over four years in 2016. In the 201920 Federal Budget a further 1 billion extended the operation of the Tax Avoidance Taskforce to 202223.

The difference between tax avoidance and tax evasion boils down to the element of concealing. TA 20205 Structured arrangements that provide imputation benefits on shares acquired where economic exposure is offset through use of derivative instruments. The Diverted Profits Tax will reinforce Australias position as having amongst the toughest laws in the world to combat corporate tax avoidance.

TA 20211 Retail sale of illicit alcohol. Tax avoidance is structuring your affairs so that you pay the least amount of tax due. Basically tax planning is legal tax evasion is illegal and tax avoidance is somewhere in between.

But its not quite as simple as that. Unlike tax evasion which is relatively easy to describe avoidance is not a criminal violation. If an individual is found guilty of tax evasion the maximum penalty is a fine of 200 penalty units about 33000 or 2 years imprisonment or both.

The line between tax avoidance and tax evasion can be very thin and at times indistinguishable. However for some time the Australian Government. Tax avoidance is organizing your undertakings with the goal that you pay a minimal measure of tax due.

The paper commences with a discussion on the distinction between tax avoidance and tax evasion in Australia and then critically examines the current approach of the. In tax evasion you hide or lie about your income and assets altogether. Usually mistakes or negligence are considered non-intentional the tax authorities however may still fine a negligent.

The distinction between tax avoidance and tax evasion has been well established in the Australian taxation system. The basic difference is that avoidance is legal and evasion is not. For those not in the know tax evasion refers to businesses or individuals who maliciously misrepresent their.

Australia is leading the global fight against multinational tax avoidance and is cracking-down on taxpayer tax evasion with a number of reforms announced as part of the 2016-17 Budget. There are many legitimate ways in. For many commentators tax avoidance includes any transaction the purpose of which is to avoid tax or to gain a tax advantage.

The test applied in judicial determinations is based on the dominant purpose of a transaction or activity and this concept underlies the anti-avoidance provisions Part IVA of the tax legislation. Australias legislative references to tax evasion do not refer to a criminal offence or even a category of criminal offences. Difference Tax Avoidance.

While tax avoidance and tax evasion are both centred around avoiding paying taxes they are very different.

Did You Know We Breathe More Microplastics Than We Eat Common Myths Mindbodygreen Myths

Tax Avoidance Difference Between Tax Evasion Avoidance Planning

Tax Avoidance Vs Tax Evasion What Is The Difference Cardens Accountants

Tax Evasion In The Oil And Gas Industry National Whistleblower Center

The Pandora Papers Show The Line Between Tax Avoidance And Tax Evasion Has Become So Blurred We Need To Act Against Both

Pin By Amanda Saad On Projects To Try Tech Company Logos Company Logo Gaming Logos

Explainer The Difference Between Tax Avoidance And Evasion

Differences Between Tax Avoidance And Tax Invasion Jarrar Cpa

Swimming With Sharks Inside The World Of The Bankers Paperback Destroyer Of Worlds Shark Entertaining Books

Explainer What S The Difference Between Tax Avoidance And Evasion

Is Tax Evasion A Federal Crime Premier Criminal Defense

Explainer The Difference Between Tax Avoidance And Evasion

What Is The Difference Between Tax Evasion And Tax Avoidance

Tax Evasion Is Unlawful Tax Avoidance Is Legal To Arrange Your Affairs In A Such A Way So As To Minimize Tax Is Quite Legal Tax Avoidance Www Trustdeedr

Tax Avoidance Vs Tax Evasion Expat Us Tax

Differences Between Tax Avoidance And Tax Invasion Jarrar Cpa

Tax Evasion Vs Tax Avoidance What S The Difference Youtube

Corporate Tax Avoidance It S No Longer Enough To Take Half Measures Joseph Stiglitz The Guardian